|

PUTTING MONEY IN THE REGISTER

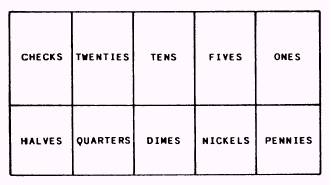

Once you have signed for your change fund as discussed earlier, you will have to arrange the cash from the change fund in your cash tray. It may seem strange, but the number of cash handling errors you make may be related to how you arrange your money in the cash tray. After you count your money, arrange it in the

cash register carefully as shown in figure 2-5. If your cash register has less than five compartments, place any checks you receive during the day under the cash -tray in the cash drawer. Make sure all bills are placed in their respective compartments, facing up in the same direction. Make sure while putting the bills in the tray that they do not stick together. If the bills are new, it is a good practice to turn the corner down on each bill to prevent giving two instead of one for change. Large bills such as $50 or $100 should always be placed under the money tray. Keep coins in their own compartments, with pennies on the right, then nickels, dimes, and quarters. Half dollars should be kept together in one compartment next to the quarters. Before ringing up your first sale of the day you should make certain the area around the cash register is clear. Do not clutter the area surrounding the cash register with signs, notes, or other items. The sales window should be clear so the customer can see the amount of sale being registered.

Figure 2-5 .- Arranging money in the register. TAKING THE CUSTOMER'S MONEY

Most errors happen during the exchange of money between the customer and the operator of the store. Before you actually take the money, ring up each item the customer is purchasing separately on the cash register. Do not try to add the total price of more than one item in your head. The cash register is designed to do this for you. Complete each transaction before thinking about starting another one. This will prevent confusing yourself and the customer and will avoid any shortages or overages in the cash re-gister. Apologize to the customer who must wait. The better you manage your customers, the fewer errors you will make in handling money. Count the money as you receive it from the customer for each sale. Repeat out loud the amount of money handed to you, as well as the amount of the sale. By doing this for every sales transaction, you avoid the chance of becoming confused if the customer should claim that a larger bill was given to you. For example, as the customer hands you this money, you should say, "Thank you, that will be $4.35 out of $5." Leave the amount of money received on the change plate until you count the change from the till. If someone interrupts you or you forget, you will have the exact amount received in front of you just below the row of keys on the register. You will not have any doubt or mistakes on the amount. Count the change twice, first as you take it from the till and second as you give it to the customer. Start counting your change from the amount rung up until you build up to the amount received. For example, if you have to ring up $4.35 out of $5, you would pickup a nickel and a dime from your till and count aloud, "Four forty, four fifty," and then pick up two quarters and count aloud, "Four seventy-five, five dollars." Repeat in the same way as you count the change into the customer's hand. If you or the customer finds an error in your count, take back all change from the customer. Make your corrections, and then count the change correctly into the customer's hand. Now remove the money from the change plate and put it in the cash drawer. Be sure to close the cash drawer after every transaction; never work out of an open cash drawer. If your cash register provides a receipt, tear the receipt off and give it to the customer. Always remember to look at your first receipt of 34 the day to make sure it prints clearly and that the date is right.

|

|