|

PERSONAL CHECKS RETURNED BY THE BANK

When a personal check, which was written for purchase in the retail store, is returned to the ship due to insufficient funds, the ship's store officer must reimburse the disbursing officer for the amount of the check from cash in the retail store register. The retail store operator will take the personal check and place it under the cash tray in the register until cash, a certified check, or money order is received for settlement. Once one of the above is received, it will be placed in the cash register and the check returned to the individual purchaser.

To account for a personal check returned, you should make a separate entry on the Cash Register Record, NAVSUP Form 469, showing that an uncollectible check is in the cash register. The amount of the check will not be written in the Amount In Figures column of the NAVSUP Form 469, instead the words Uncollectible Check will be entered here so it will not be totaled at the end of the month. Once the money is received for the check from the individual purchaser, the amount will be shown on the Cash Register Record, NAVSUP Form 469, for information purposes. The amount will not be included in the total figure but the words Settled Check will reentered in the Amount In Figures column of the NAVSUP Form 469 to indicate the check is settled. Keep in mind that the amount of money received to cover the check will not be rung up in the register but just placed in the cash drawer and the check returned to the individual purchaser. If the check is not settled by the end of the accounting period or when the retail store operator is relieved, the retail store operator should make sure the check is included on the inventory prelisting and the amount of the check included in the inventory. If, after repeated attempts, the ship's store officer fails to collect the amount of the check, it will reconsidered uncollectible after 4 months. The amount of the check will have to be charged as an operating expense of the ship's store. The amount of the uncollectible check will be reported on the Cash Register Record, NAVSUP Form 469, for information purposes only. The words Dishonored Check will be entered in the Amount In Figures column of the NAVSUP Form 469 to make sure the amount of the dishonored check is not included in the monthly total. The dishonored check will be removed from the register and turned over to the ship's store officer.

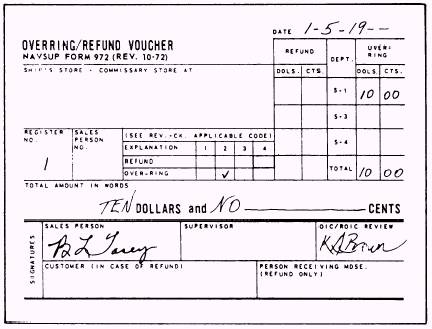

Figure 2-7.- Overring/ RefundVoucher, NAVSUP Form 972 (for overrings). At the end of the accounting period, a Memorandum Invoice, DD Form 1149, will be prepared listing all dishonored checks. The invoice will contain the following: Name and social security number of each check drafter

Date of check

Bank and bank account the check was drawn from

Amount of check A separate entry will be made for all dishonored checks by the office recordskeeper on the Ship's Store Afloat Financial Control Record, NAVSUP Form 235, to adjust the retail store operator's accountability. ROM users will create a separate Intra-Store Transfer Data, NAVSUP Form 973, for dis-honored checks from the retail store to the bulk storeroom to adjust the retail stores accountability on the Ship's Store Afloat Financial Control Record, NAVSUP Form 235. After the ship's store officer verifies that an intrastore transfer was accomplished to adjust accountability, he or she will change the balance on the Stock Record, NAVSUP Form 464, to zero through the ROM corrections function and delete the stock record.

|

|